How do digital nomads pay taxes?

The rise of remote working throughout the COVID-19 pandemic has opened new opportunities for many people wanting to escape the office full-time. Not only can employees work from their own homes, but they can choose to establish a home office anywhere – even if it’s in another country.

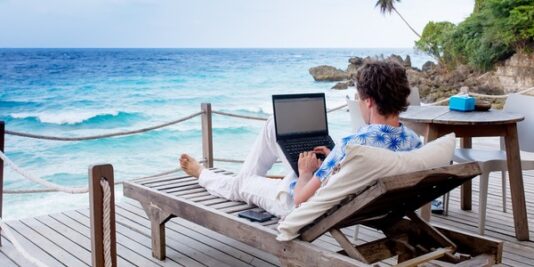

If all you need to do your job is your computer and a secure internet connection, why wouldn’t you want to set up shop somewhere better? Becoming a digital nomad seems like a dream come true for most workers. However, it’s not always that easy to relocate overseas whilst keeping the same job in your country of origin. Time zones and accessibility aside, residency and taxation can be a roadblock.

Let’s look into what it takes to be a digital nomad, and what this style of remote working means for individuals and employers when it comes to work permits, residency visas, and international taxes.