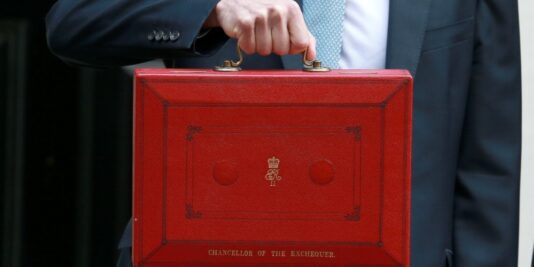

Have you received an HMRC letter about miscalculated Corporation Tax relief?

If your company has miscalculated its marginal Corporation Tax relief, you may be due to receive a letter from HMRC – if you haven’t already as part of the tax agency’s new campaign.